The outlook for the graphite market is promising due to its usage in the battery industry and energy storage applications, as well as steel-making.

With China dominating the natural graphite market, synthetic graphite is poised to capitalize on rising demand for graphite in the technologies.

Understanding what synthetic graphite is and how it differs from natural graphite is important for investors, as each industry typically needs a specific type of graphite. Here’s a look at the synthetic graphite market and what it has to offer.

In this article

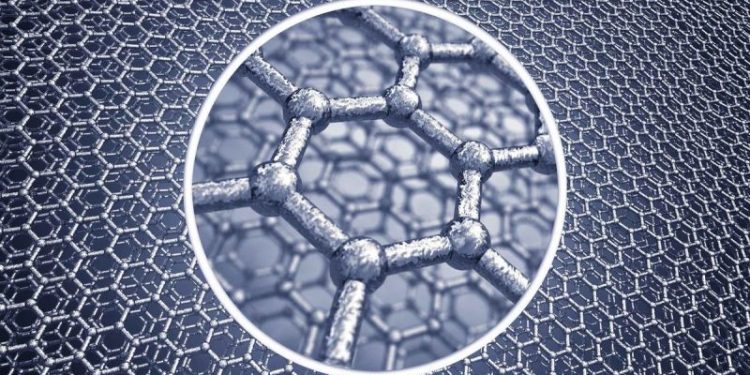

What is synthetic graphite?

Synthetic graphite is an industrial material that is artificially made from hydrocarbon precursors. It is able to withstand high temperatures and corrosion.

Those points make it a great option for highly specialized industries that need predictable results from carbon materials, such as metal fabrication, solar panels, electric vehicle batteries and grid-scale energy storage systems.

What are the uses of synthetic graphite?

Synthetic graphite uses cover a variety of applications, including energy storage applications and steel manufacturing, and its particular uses are dependent on its form.

Synthetic graphite typically comes in two forms: electrodes and graphite blocks. The form of synthetic graphite directly determines which industries it will be used in.

- Electrodes: Synthetic graphite electrodes are primarily created using petroleum coke as a precursor and are almost exclusively found in electric-arc furnaces — these furnaces are used for melting steel and iron, and producing ferroalloys.

- Graphite blocks: Synthetic graphite blocks, or isotropic graphite, are primarily used for energy storage in the solar industry. These blocks are made using the same petroleum coke process as electrodes, but differ slightly in the structure of the coke used.

- Secondary synthetic graphite: Secondary synthetic graphite is a by-product material of synthetic graphite production, and it is typically yielded as a powder. This by-product is considered a low-cost graphite material and some forms of it can compete with natural graphite in applications like brake linings and lubricants.

- Primary synthetic graphite: Primary synthetic graphite is typically manufactured in powder form and used for high-end lithium-ion batteries. However, it is more expensive to produce and can cost the same amount as manufacturing an electrode. Unlike its secondary counterpart, primary synthetic graphite is not a by-product material.

How is high-performance battery-grade synthetic graphite made?

Battery-grade synthetic graphite is made from heat-treating at very high temperatures a blend of lower purity carbon-based raw materials with coal tar pitch, petroleum coke or oil. This creates a uniform carbon structure suited for high performance, long-lasting electric vehicle batteries.

Is synthetic graphite better than natural graphite?

As for how synthetic graphite compares to natural graphite, synthetic graphite is purer than natural graphite in terms of carbon content and tends to behave more predictably. This makes synthetic graphite a better option than natural for use in high-performance applications that require higher efficiency and reliability such as lithium-ion batteries for electric vehicles.

On the flip side, as the process is energy intensive, synthetic graphite production can be significantly more expensive than that of natural graphite, and the environmental impact of synthetic graphite is worse as well.

‘Synthetic graphite anode production can be over four times more carbon intensive than natural graphite anode production, due to its use of energy and fossil fuels as a feedstock,’ according to Benchmark.

These higher economic and environmental costs for producing synthetic graphite has led graphite end users to substitute natural graphite for synthetic graphite in battery anodes.

How big is the synthetic graphite market?

The global synthetic graphite market size is expected to come in at US$3.41 billion in 2025, according to Mordor Intelligence, and is projected to growing at a CAGR of 6.83 percent to reach more than US$4.74 billion by 2030.

In terms of overall graphite demand, Benchmark Mineral Intelligence expects to see a supply deficit from growth in the battery sector moving forward.

As a whole, it appears graphite’s future is bright. However, synthetic graphite will still face somewhat of an uphill battle. For one, improvements in natural graphite purity are helping it enter the nuclear technology and high-end battery markets, which have typically been owned by synthetic graphite.

Price will certainly continue to be a determining factor in the competition between natural and synthetic graphite. Data from S&P Global Market Intelligence shows that processing synthetic graphite is three times as energy intensive as processing natural graphite, which translates into higher costs for the artificial material.

Going forward, higher synthetic graphite prices are expected, as are higher natural graphite prices, as demand rises and electric vehicle battery manufacturers vie for the limited supply outside of China.

Synthetic graphite stocks

The global synthetic graphite market is “partially consolidated” and dominated by a handful of major companies, according to a report by Mordor Intelligence. The top five players in this space are:

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.